tax strategies for high income earners 2021

Change the Character of Your Income. If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions meaning you.

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

Mon - Fri.

. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year. Max Out Your Retirement Account. Pull Income Forward to Take Advantage of Todays Tax Brackets.

For 2022 the maximum employee deferral to 401 k is 20500. Year-Round Tax Reduction Strategies For High-Income Earners. You can do so tax-free up to.

That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you. Potential changes coming up the legislative pipeline could also. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Trial Tax Return. Family Income Splitting and Family Trusts. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners.

5 strategies to minimize taxes for high income individuals. We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000.

Tax Saving Strategies for High-Income Earners. In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

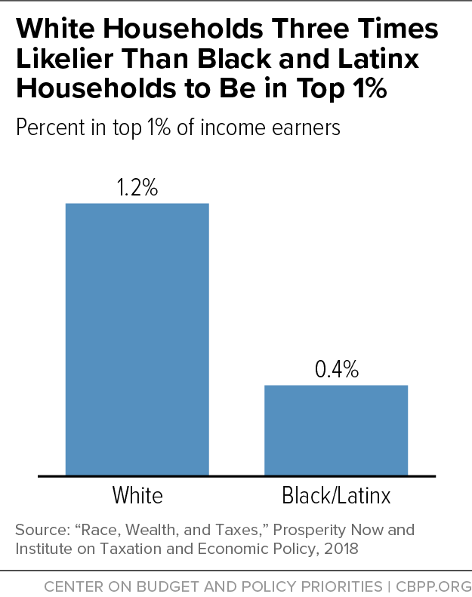

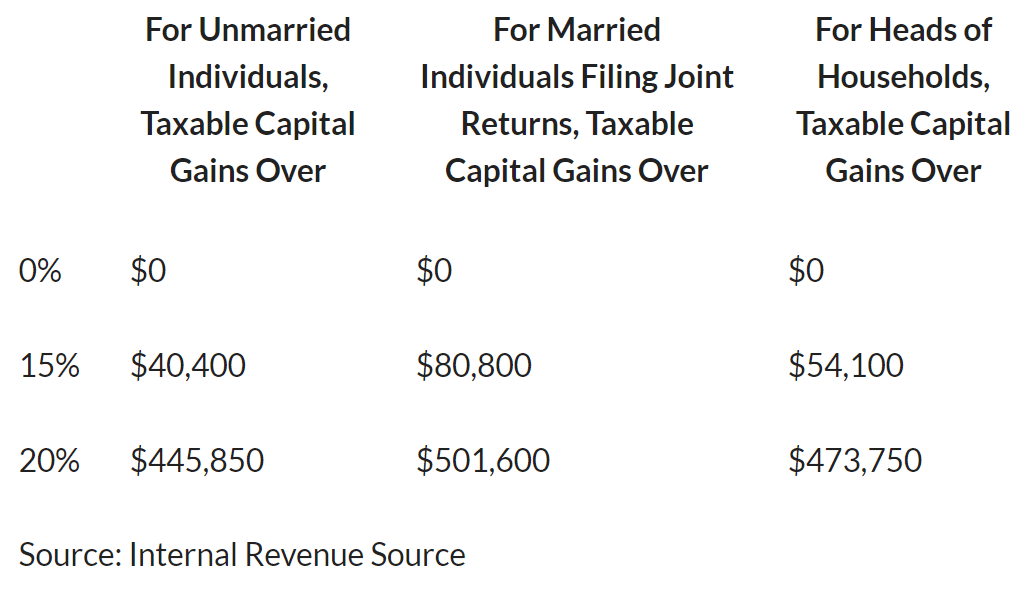

The top rate for 2021 applies to individuals earning more than 523600 or more than 628300 for married couples filing jointly. One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Here are helpful tax strategies for high-income earners that help increase savings.

Due to the pandemic and stimulus payments the federal governments tax filing season for individual. Under RS rules you can deduct charitable cash contributions. One strategy for wealthy families to consider is pulling.

Lets start with an overview of tax rules for high-income earners. For 2021 the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. Donate More to Charity.

Wealth preservation tax code strategies to reduce income and capital gains tax. Its possible that you could. The maximum allowable contribution for 2021 was 19500 but for 2022 the cap has.

Eliminate the 20 percent long-term capital. The 2022 annual limit is 20500. Finance Strategies for High-Income Earners 1.

1441 Broadway 3rd Floor New York NY 10018. For instance the. Its estimated that 90.

This is one of. Dont discount the wealth-generating potential and flexibility an HSA can afford. Tax Planning Strategies for High-income Earners.

Tax Saving Strategies For High Income Earners Ubos

High Income Earners Need Specialized Advice Investment Executive

6 Strategies To Reduce Taxable Income For High Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark

The 4 Tax Strategies For High Income Earners You Should Bookmark

The 4 Tax Strategies For High Income Earners You Should Bookmark

High Income Tax Planning Strategies Wade Financial Advisors

Improved State Taxes On Wealth High Incomes Can Help Fuel An Equitable Recovery Center On Budget And Policy Priorities

9 Ways To Reduce Your Taxable Income Fidelity Charitable

5 Outstanding Tax Strategies For High Income Earners

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Tax Strategies For High Income Earners Taxry

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Individuals Youtube

Tax Strategies For High Income Earners Taxry

Hot Income Tax Strategy For High Earners Commercial Solar

5 Outstanding Tax Strategies For High Income Earners

Taxbuzz Com On Twitter Q7 What Is Your Best Tax Planning Strategy For High Income Earners Taxbuzzchat Https T Co Ccqoxmngh2 Twitter

:max_bytes(150000):strip_icc()/Term-Definitions_backdoor-roth-ira-ef8e60bcd8a84c80ae9bc8d4f05bd04d.png)